As you prepare to leave Yale, you may find the tips below helpful.

For immigration-specific information go to F-1 Students or J-1 Students.

Report Your Forwarding Address

- Leave your permanent home address with OISS

- Leave your permanent home address with your school, department, faculty adviser and others who might wish to be in contact with you.

- Fill out a change of address postcard at the Post Office or at the USPS website. U.S. government mail (including immigration notices) will not be forwarded.

Scholarships, Wages and Taxes

If you received any scholarships, fellowships or wages from Yale in your final year, you will likely need to file a U.S. tax return. Email the Payroll Office at payroll.taxforms@yale.edu to report your forwarding address. In the email, make sure to list your full name, last 4 digits of your SSN, your old New Haven address and the new forwarding address where your future tax forms (W‐2, 1042‐S, and/or 1099 forms) can be sent.

Library Materials

Return all books and other materials to the library.

Health Coverage

- If you are a May graduate, you are automatically covered until the end of July.

- If you complete your degree at a time other than commencement in May or if you are a non-degree student, contact Yale Health Plan Member Services to learn when your coverage ends.

- Learn more on Yale Health's website.

Passports

Obtain passports for all U.S. born children (it can take up to 12 weeks). Contact the U.S. Department of State Passport services at travel.state.gov/passport.

Accounts

- Settle accounts with businesses, publications, insurance companies, credit cards, etc.

- Close your bank account if you will not be using it anymore. Some prefer to leave the account open if they expect to receive additional payments (including tax refunds) after leaving Yale.

Technology

Your NetID and password will be turned off shortly after your departure, so you should make sure to back up any data or email you may need. Students can find out more here.

Off-Campus Housing

- Notify your landlord of your departure date (refer to your lease as to how much notice you need to give). Be sure to check about any necessary procedures that may be required of you before you leave. Return your keys, and in writing, leave a forwarding address and request the return of your security deposit.

Notify Utility Companies

- If you are responsible for utility payments, inform the utility companies (gas, electricity, water, cable, phone) about your departure. Ask if you can pay the bills before you leave. If you will be getting a return on any of your deposits, arrange to receive the refund.

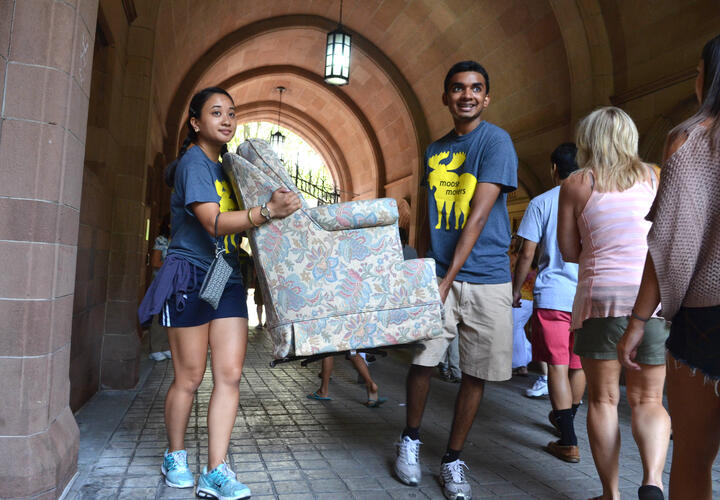

Donate or Sell Your Stuff

- If you have household items to pass on, donate them to friends or local charities, give them away on Free Cycle, www.freecycle.org, or sell them on newhaven.craigslist.org

Shipping

- Consult your country's embassy to determine what customs regulations you will need to consider when taking or shipping your belongings home.