What is a Form 8843 and Who Must File One?

Form 8843 is not a U.S. income tax return. It is an informational statement required by the IRS for nonresidents for tax purposes. It should be submitted for every nonresident tax payer present in the U.S. at any point during the previous calendar year, including spouses, partners, and children.

If you are not sure whether you are a nonresident for tax purposes, please read this section to find out more.

Nonresident Tax Filers

- If you are a nonresident tax filer with U.S. source income and are using Sprintax to file your tax return, your Form 8843 will be automaticaly generated and included in the forms that Sprintax prepares for your filing.

- If you are preparing your 1040NR form yourself without using a tax software, you must also include a Form 8843.

Resident Tax Filers

- If you are considered a resident for tax purposes, you are not required to file Form 8843.

Who Should Complete ONLY Form 8843?

If you are a nonresident tax filer, and had NO U.S. source income in 2024, you only need to complete the Form 8843 to fulfill your federal tax filing obligation. Continue reading to find out how you can file this form.

What Does it Mean to Have No U.S. Source Income?

It means you did not receive wages, salary, awards, prizes, or taxable scholarship or fellowship (i.e. the amount of scholarship or fellowship that exceeds the amount of your tuition [consider only your tuition; do not include any other expenses such as books, or room and board]) from a U.S. institution, organization, or company. Financial support, such as sabbatical salary or a scholarship from your home country or an organization outside the U.S., is not considered U.S. source income.

Instructions for Completing Form 8843

You only need to fill out certain parts of Form 8843, depending on your visa status. Read the following sections for information specific to your status.

First, obtain your Form 8843:

- Download the PDF from the IRS website

- Next, do one of the following:

- Fill out the form* on your computer using Adobe Acrobat and print

- Print the form and fill it out* very clearly using a pen

*When filling out the form, use the instructions below to determine which sections you must fill out and which you can leave blank.

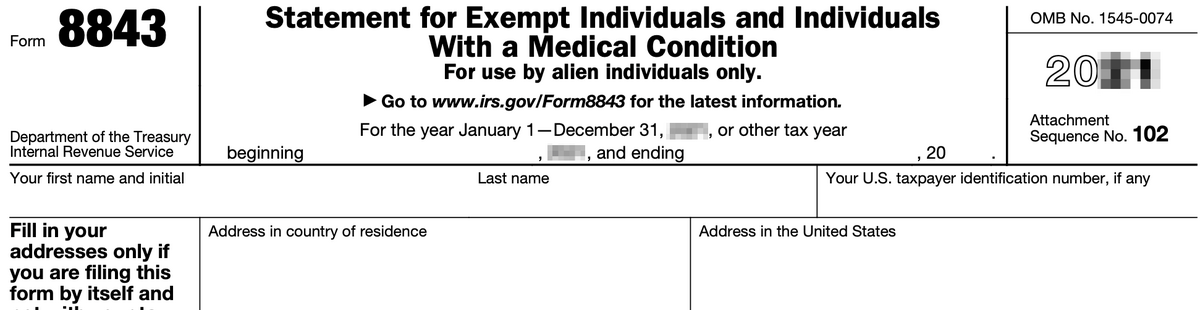

Top Portion

- Complete the top portion of the form with your name (as it appaears on your passport) and addresses.

- If you have an SSN (Social Security Number) or ITIN (Individual Tax identification Number), you can write it in the top right box (Your U.S. taxpayer identification number, if any). However, you do not need an SSN or ITIN if you are only filing Form 8843. You can leave this box blank if you do not have either of them.

Part I: General Information

Answer each question. Here are tips to help clarify some of the questions:

- Line 1a: Write your visa status for your most recent entry to the U.S. and the date of your most recent entry

- Line 1b: Write your current nonimmigrant visa status (mostly the same as line 1a)

- Line 4a: Write the actual number of days you were physically present in the U.S. for the years indicated

- Line 4b: Write the same number of days you wrote in 4a for 2024.

Part II: Teachers and Trainees

Skip this section.

Part III: Students

Answer each question. Here are tips to help clarify some of the questions:

- Line 9: Write Yale University, New Haven, CT 06511. (203) 432-2305

- Line 10: Write Ozan Say, OISS, Yale University, New Haven, CT 06511. (203) 432-2305

- Line 11: Write your visa status only for the years you were present in the U.S. Otherwise leave it blank.

Part IV: Professional Athletes

Skip this section.

Part V: Individuals With a Medical Condition or Medical Problem

Skip this section.

Bottom Portion

Sign and date on the last line of page 2.

Next Steps

- Make a copy of the completed form and save it for your records (electronic and print).

- Mail the form to the IRS using the information at the bottom of this page. We recommend that you choose tracking and receipt confirmation when you mail as the receipt conformation will be your only form of proof that you have mailed Form 8843. IRS will not send you any confirmation of receipt.

First, obtain Form 8843:

- Download the PDF from the IRS website

- Next, do one of the following:

- Fill out the form* on your computer using Adobe Acrobat and print

- Print the form and fill it out* very clearly using a pen

*When filling out the form, use the instructions below to determine which sections you must fill out and which you can leave blank.

Top Portion

Answer each question. Here are tips to help clarify some of the questions:

- Complete the top portion of the form with your name (as it appaears on your passport) and addresses.

- If you have an SSN (Social Security Number) or ITIN (Individual Tax identification Number), you can write it in the top right box (Your U.S. taxpayer identification number, if any). However, you do not need an SSN or ITIN if you are only filing Form 8843. You can leave this box blank if you do not have either of them.

Part I: General Information

Answer each question. Here are tips to help clarify some of the questions:

- Line 1a: Write your visa status for your most recent entry to the U.S. and the date of most recent entry

- Line 1b: Write your current nonimmigrant visa status (mostly the same as line 1a)

- Line 4a: Write the actual number of days you were physically present in the U.S. for the years indicated

- Line 4b: Write the same number of days you wrote in 4a for 2024.

Part II: Teachers and Trainees

Answer each question. Here are tips to help clarify some of the questions:

- Line 5: Write Yale University, New Haven, CT 06511. (203) 432-2305

- Line 6: Write Ozan Say, OISS, Yale University, New Haven, CT 06511. (203) 432-2305

- Line 7: Write your visa status only for the years you were present in the U.S. Otherwise leave it blank.

Part III: Students

Skip this section.

Part IV: Professional Athletes

Skip this section.

Part V: Individuals With a Medical Condition or Medical Problem

Skip this section.

Bottom Portion

Sign and date on the last line of page 2.

Next Steps

- Make a copy of the completed form and save it for your records (electronic and print).

- Mail the form to the IRS using the information at the bottom of this page. We recommend that you choose tracking and receipt confirmation when you mail as the receipt conformation will be your only form of proof that you have mailed Form 8843. IRS will not send you any confirmation of receipt.

First, obtain Form 8843:

- Download the PDF from the IRS website

- Next, do one of the following:

- Fill out the form* on your computer using Adobe Acrobat and print

- Print the form and fill it out* very clearly using a black pen

*When filling out the form, use the instructions below to determine which sections you must fill out and which you can leave blank.

Top Portion

Answer each question. Here are tips to help clarify some of the questions:

- Complete the top portion of the form with your name (as it appears in your passport) and addresses.

- If you have an SSN (Social Security Number) or ITIN (Individual Tax identification Number), you can write it in the top right box (Your U.S. taxpayer identification number, if any). However, you do not need an SSN or ITIN if you are only filing Form 8843. You can leave this box blank if you do not have either of them.

Part I: General Information

Answer each question. Here are tips to help clarify some of the questions:

- Line 1a: Write your visa status for your most recent entry the U.S. and the date of most recent entry

- Line 1b: Write your current nonimmigrant visa status (mostly the same as line 1a)

- Line 4a: Write the actual number of days you were physically present in the U.S. for the years indicated

- Line 4b: Write the same number of days you wrote in 4a for 2024.

Part II: Teachers and Trainees

Skip this section.

Part III: Students

Skip this section.

Part IV: Professional Athletes

Skip this section.

Part V: Individuals With a Medical Condition or Medical Problem

Skip this section.

Bottom Portion

Sign and date on the last line of page 2. A parent can sign for any dependents under the age of 14.

Next Steps

- Make a copy of the completed form and save it for your records (electronic and print).

- Mail the form to the IRS using the information at the bottom of this page. We recommend that you choose tracking and receipt confirmation when you mail as the receipt conformation will be your only form of proof that you have mailed Form 8843. IRS will not send you any confirmation of receipt.

What is the Deadline for Submitting Form 8843?

April 15, 2025

Where Do I Mail My Completed Form 8843?

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0215

The instructions for completing Form 8843 can be found on page 3 and 4 of IRS form 8843. The information above is a simplified version of these instructions.